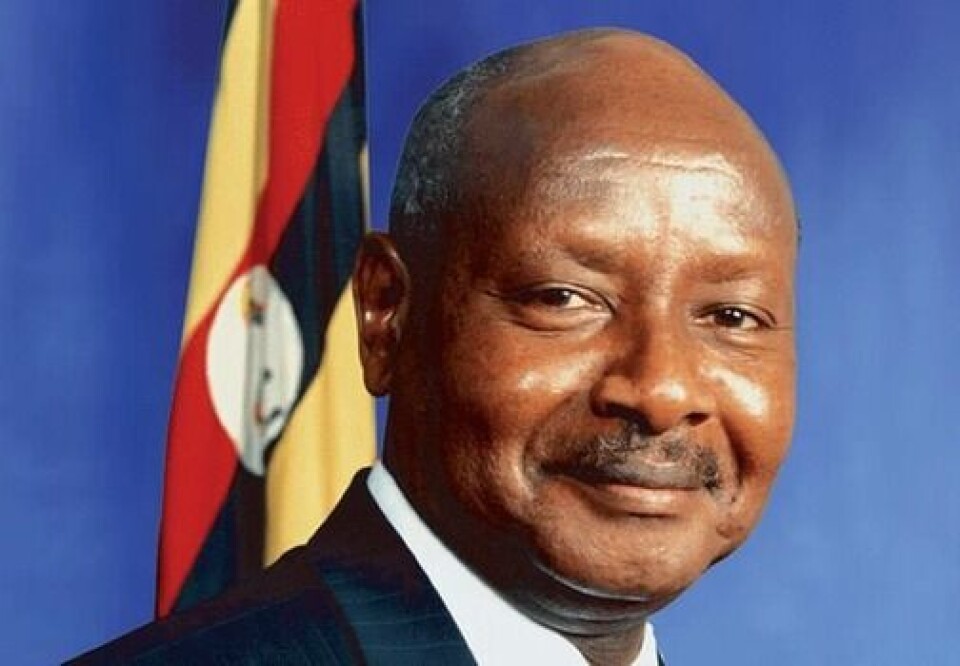

Until now Section 21 (1)(q) of the Ugandan Income Tax Act only exempted the official employment income of a person employed in the Uganda Peoples’ Defence Forces, Police Force and Prisons Service from tax. Now Ugandan president Yoweri Museveni has approved an income tax exemption for employees in the Office of the Director of Public Prosecutions too.

"This issue of tax exemption came up and I said let us leave them (prosecutors). I told the (finance ministry) to leave them, don't tax them. Somebody tried to argue that everybody must be taxed, but I said, soldiers are not taxed. The policemen and judges too are not paying taxes," Museveni said during a lecture in Kampala.

"Since these people are on the frontline of fighting crime, let’s finish with them and they fail on their own. I have already told the Ministry of Finance that let this category (prosecutors) be exempted and I insist on it," the president further stated.

The president's declaration followed an appeal by the Director of Public Prosecutions, Frances Abodo, who asked the president to consider prosecutors for exemption of income tax.

"We ask that the Income Tax Act is amended to add prosecutors to the list of those who are exempted from paying the tax. We also want to receive our salaries in full without deductions," Abodo begged the president. During a previous parliamentary session, Abodo lamented the fact that her office was losing the majority of their experienced staff to the judiciary as a result of poor remuneration.

Although the tax waiver for prosecutors has been approved by the president, it cannot be implemented unless the lawmakers vet it and approve it.

During a subsequent sitting of the Finance Committee, Hon. Keefa Kiwanuka, chairperson of the committee, said his committee recommends that Section 21(1)(q) of the Income Tax Act be amended to include employees in the Office of the Director of Public Prosecutions.

However, some of the lawmakers have opposed the provision of tax waivers by the president, noting that it may have serious fiscal implications. Enos Asiimwe, the lawmaker representing Kabula County, argued that the waiver may be exploited by other groups.

"The problem is that the Ministry of Finance will deny you the exemption, and give it to someone else in billions. That is why we are passing a blanket opinion that we shouldn’t issue any more exemptions," Asiimwe said.

Another lawmaker, Hon. Muwanga Kivumbi, suggested that the government increase the salaries of state prosecutors rather than exempting them from tax. "This piecemeal exemption of taxation is not good. All the other sectors will now come out saying the same," he said.

Uganda is not the only country to follow this practise; in 2022 the Nigerian government made a similar move, approving tax relief for junior police officers to improve their welfare and standard of living.

To join Africa Legal's mailing list please click here