Copyright : Re-publication of this article is authorised only in the following circumstances; the writer and Africa Legal are both recognised as the author and the website address www.africa-legal.com and original article link are back linked. Re-publication without both must be preauthorised by contacting editor@africa-legal.com

Nigeria’s windfall tax: Economic stability or hardship?

There has been uproar and concern, particularly in the Nigerian banking sector, since Nigeria’s parliament passed the Finance Amendment Bill of 2024, which will see the introduction of a huge one-off windfall tax.

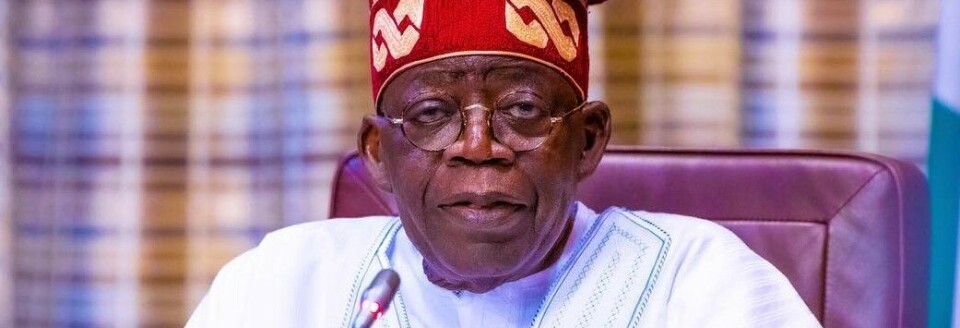

President Bola Tinubu originally asked lawmakers to approve an amendment to the 2023 Finance Act to allow for a one-time 50% tax on the foreign exchange gains made by Nigerian banks following the devaluation of the naira in 2023. The Senate increased this to 70%. The law is due to be applied retroactively, with effect from 1 January 2023, up to the commencement of the new foreign exchange policy in the 2025 financial year.

There may still be legal challenges to the new legislation, and many experts are predicting it will bring further hardship to the country as a whole.

While assessing the implications of the amendment for the Nigerian economy, Chidinma Edith Oko-Egwu, a Tax Associate at ALP NG & Co commented that, from a governmental perspective, the tax will certainly increase federal revenue, providing a much-needed boost to fund fiscal projects and reduce deficits.

However, Oko-Egwu believes that the innovation could have other negative ripple effects. “While the windfall tax aims to curb excessive profits from the devaluation of the naira, it could significantly reduce the net earnings of banks, potentially affecting their capital base and ability to reinvest in the economy. Banks might also pass on the additional tax burden to customers, leading to higher service fees and interest rates,” she noted.

“Another potential impact is a reduction in bank lending. As banks face lower profitability due to the windfall tax, they may become less willing to take on risks, including lending to businesses and individuals. This could hinder economic growth by limiting access to credit. Additionally, the windfall tax could incentivise banks to seek ways to minimise their tax liability, potentially through profit-shifting offshore or other strategies.”

Considering such a high taxation to be a harsh penalty, Oko-Egwu cautioned that “there is a risk that overtaxing a critical sector like banking may deter further investments and growth, as the tax structure is perceived as punitive”.

Obajimi Olamide, Tax Partner at Olaniwun Ajayi, believes that the development will undermine investors’ confidence in the Nigerian banking sector and economic stability. “The introduction of the windfall tax during a period of banking sector recapitalisation and major tax reform efforts may foster distrust among investors,” he said. “The prevailing narrative from the FG through the Presidential Committee for Fiscal and Tax Reforms emphasises tax consolidation rather than an increase in the number of taxes. The introduction of this windfall tax, therefore, could be perceived as contradictory to this objective, potentially undermining investor confidence in the regulatory environment and discouraging both domestic and foreign investment.”

In addition, Olamide noted that the bill’s retrospective application, with a commencement date set to January 2023, raises concerns regarding legal and fiscal fairness. “It contradicts the established principle that tax laws should generally apply prospectively unless explicitly stated otherwise. This approach not only undermines the national tax policy, but also subjects banks to taxation on foreign exchange gains for which they have already filed tax returns and settled the relevant companies’ income tax liabilities for the relevant periods. Such retroactivity implies that the same tax base will suffer tax twice,” he concluded.